The Government of India has unveiled a landmark GST reform, described as a “Historic Diwali Gift for the Nation.” This reform, termed the Next-Gen GST, is aimed at easing the cost of living, boosting small businesses, and strengthening the dream of Aatmanirbhar Bharat. With sweeping tax reductions across essential items, healthcare, education, agriculture, automobiles, and electronic appliances, this move is set to benefit households, farmers, MSMEs, and the overall economy.

GST Relief on Daily Essentials

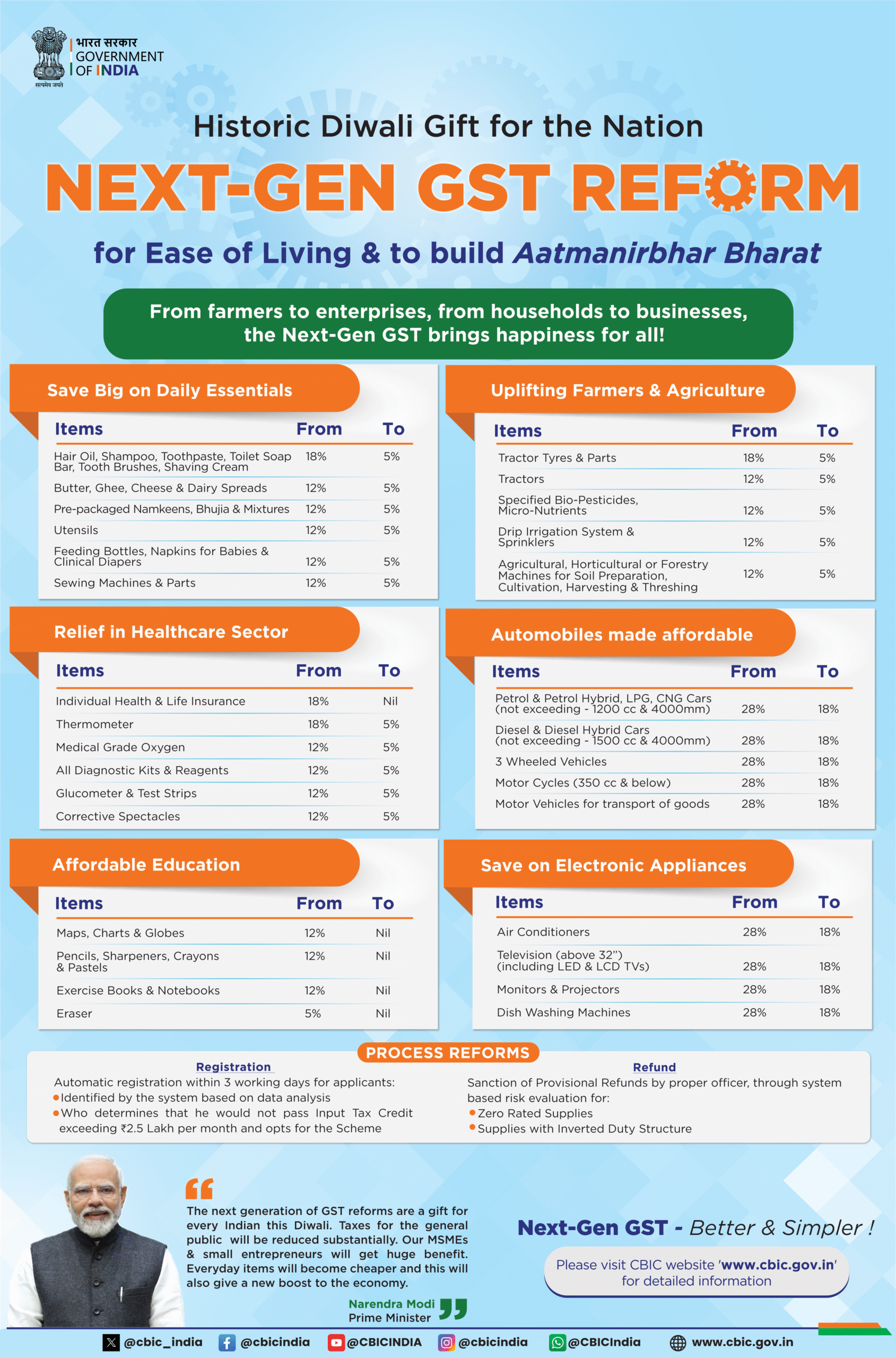

For millions of households, this reform means immediate savings on everyday items. Essential goods such as hair oil, shampoo, toothpaste, toilet soap, shaving cream, butter, ghee, cheese, dairy spreads, pre-packaged namkeens, bhujia, and mixtures will now attract a GST rate of just 5% instead of the earlier 12–18%.

Even household items such as utensils, feeding bottles, sewing machines, and parts have witnessed reductions from 12–18% GST to just 5%. This reform directly touches the lives of common citizens, lowering the cost of necessities used daily.

Relief in Healthcare Sector

Healthcare has been one of the sectors where affordability directly impacts citizens. Under the new GST regime:

Individual health and life insurance will now attract zero GST, down from 18%.

Thermometers, medical grade oxygen, diagnostic kits, reagents, and glucometers have all been brought under a 5% tax slab, down from 12–18%.

Even corrective spectacles will now be taxed at just 5% instead of 12%.

This will make healthcare services and equipment more affordable, especially for middle-class and lower-income families.

Affordable Education for All

Education is the backbone of national development, and this GST reform directly supports it. Items such as maps, charts, globes, pencils, sharpeners, crayons, pastels, exercise books, notebooks, and erasers will now attract zero GST.

By eliminating the tax burden on educational supplies, the government has provided substantial relief to students and parents, making learning more accessible and affordable.

Uplifting Farmers and Agriculture

Agriculture, the backbone of India’s economy, has received a major push in this reform. Key items that support farming activities such as tractor tyres and parts, tractors, drip irrigation systems, sprinklers, specialized bio-pesticides, and micro-nutrients will now attract a reduced GST of just 5%, down from the previous 12–18%.

Moreover, agricultural, horticultural, and forestry machinery for soil preparation, cultivation, harvesting, and threshing also enjoy the reduced 5% rate. This will not only lower farming costs but also encourage mechanization and modern farming practices, boosting productivity.

Automobiles Made Affordable

The automobile industry, which directly impacts middle-class aspirations, has also witnessed big changes. Key highlights include:

Petrol, diesel, LPG, and CNG hybrid cars (within certain capacity limits) will now attract 18% GST, down from 28%.

Three-wheeled vehicles and motorcycles (up to 350cc) will also see reduced rates.

Vehicles used for goods transport now fall under the 18% slab instead of 28%.

This reform makes mobility more affordable for both personal and commercial use, helping middle-class families and small businesses.

Savings on Electronic Appliances

In a move that will directly benefit households, the government has slashed GST on major electronic appliances:

Air conditioners, televisions (above 32 inches), monitors, projectors, washing machines, and dishwashers will now attract 18% GST instead of 28%.

This reduction will not only bring cheer to consumers upgrading their homes but also give a much-needed boost to the electronics and home appliances industry.

Process Reforms for MSMEs and Startups

Apart from tax cuts, the government has also simplified GST procedures:

Businesses opting for the scheme will enjoy simplified compliance if their monthly input tax credit does not exceed ₹2.5 lakh.

Provisional refunds will be sanctioned quickly based on system-driven risk evaluations, particularly benefiting zero-rated suppliers and businesses facing inverted duty structures.

These reforms will provide immense relief to small and medium businesses, reducing compliance burdens and improving cash flows.

Prime Minister’s Vision

Prime Minister Narendra Modi hailed the reform as a “Gift for every Indian this Diwali.” He emphasized that these measures will:

Substantially reduce taxes for the general public.

Provide massive benefits to MSMEs and small entrepreneurs.

Make everyday items cheaper.

Boost the Indian economy with renewed energy.

A Step Towards Aatmanirbhar Bharat

The Next-Gen GST Reform is not just a tax relief but a strategic economic move. By reducing costs on essentials, healthcare, education, agriculture, and electronics, it directly improves the quality of life for citizens. Simultaneously, it empowers farmers, MSMEs, and industries, paving the way for sustainable growth.

As India celebrates Diwali, this reform comes as a beacon of hope and prosperity, aligning with the vision of a self-reliant, resilient, and growing India.

Thats The good Gift For India