In a dramatic turn of events, global stock markets stumbled early this week as trade tensions between the U.S.–China reignited with unexpected intensity. The sudden move by Washington to threaten higher tariffs on a broad range of Chinese imports sent a wave of uncertainty rippling across financial hubs in Asia and Europe, rattling investors and reigniting fears of another economic standoff between the world’s two largest economies.

The news hit global markets like a lightning bolt. Within hours, major Asian indexes from Tokyo’s Nikkei to Hong Kong’s Hang Seng plunged, reflecting growing anxiety among traders about potential disruptions to global trade and supply chains. In Europe, the downturn spread quickly, dragging regional equities and commodities lower as investors shifted toward safer assets like gold and government bonds.

The move comes at a time when the world economy is only beginning to stabilize after years of inflation pressures, geopolitical conflicts, and slowing growth. For many, this escalation feels like déjà vu a reminder of the bruising trade war of 2018–2019, when tariffs and retaliations sent shockwaves through markets worldwide.

A Familiar Storm Returns

The new trade dispute comes just months after talks between U.S.–China officials had shown signs of easing. However, over the weekend, the White House signaled that it may impose additional tariffs on Chinese goods, accusing Beijing of “unfair trade practices” and currency manipulation.

This announcement immediately shook Asian markets on Monday morning. The Nikkei in Japan fell more than 2%, Hong Kong’s Hang Seng dropped sharply, and Shanghai’s Composite Index slipped despite China reporting stronger-than-expected export growth for September.

Financial analysts say the market’s reaction reflects the deep concern that renewed trade barriers could slow down the global recovery that has only recently gained momentum after years of pandemic and inflation pressures.

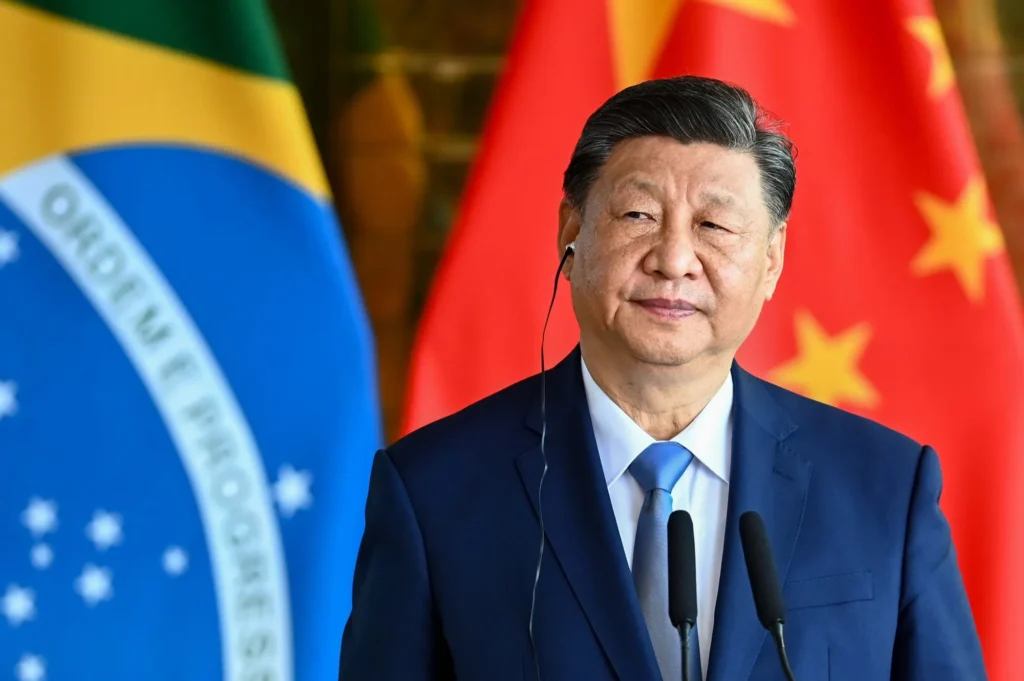

China’s Response: Calm but Firm

Beijing’s response has been measured yet unmistakably firm. In an official statement, China’s Commerce Ministry said that it “strongly opposes unilateral tariff actions” and emphasized that dialogue, not confrontation, remains the best way forward.

Despite the tension,U.S.–China exports unexpectedly grew by nearly 8% last month, defying forecasts that trade restrictions would shrink overseas demand. Economists suggest this resilience may give Beijing a slightly stronger position in upcoming negotiations.

Still, investors fear that if Washington moves forward with fresh tariffs, China could retaliate with its own counter-measures, potentially escalating into a full-blown trade war 2.0 something the world economy can ill afford.

Global Repercussions

The ripple effects were immediately visible. European markets opened lower, with the FTSE 100 and DAX both losing ground amid concerns that the renewed trade fight could hurt manufacturing exports. In the U.S., futures markets pointed to a lower opening as Wall Street traders prepared for a volatile week.

The Bank of England and other major financial institutions have also warned that the global system remains “vulnerable to shocks”, particularly in times of political or trade instability. A new U.S.–China dispute could further strain global supply chains and push up prices at a time when inflation remains sticky in several advanced economies.Conomists suggest this resilience may give Beijing a slightly stronger position in upcoming negotiations.

Experts Urge Diplomacy

Economists and policy experts around the world are urging both sides to return to the negotiating table.

Dr. Maria Gonzalez, an international trade analyst at Oxford Economics, said:

“The global economy is still fragile. If the U.S.–China escalate this into another tariff war, it won’t just hurt them it will slow down growth across Asia, Europe, and emerging markets.”

Analysts argue that cooperation, rather than confrontation, is essential for ensuring global stability in a world increasingly defined by interconnected economies and shared vulnerabilities.

Conclusion: The World Watches Closely

As Washington and Beijing prepare for another round of high-level talks later this month, investors and policymakers are watching closely. The stakes are enormous not just for two superpowers, but for every nation whose economy is tied to global trade.

If diplomacy prevails, markets could rebound quickly. But if tensions deepen, 2025 might mark the beginning of another turbulent chapter in international economics one where the world’s financial future once again hangs on the fragile balance between cooperation and conflict.